Let’s Talk New Reverses

RMI Can Help You Make The Most of Current Market Conditions

Find More Reverse Borrowers Much Faster.

RMI makes it quick and simple.

When you need to know quickly exactly who qualifies,

You Need Our Unmatched Industry Data Analytics.

When you need to know confidently where to target your sales and marketing of reverse mortgages,

It’s Time to Talk to RMI.

"*" indicates required fields

Reverse Qualifier

Reverse Qualifier leverages our unmatched industry data analytics and integrates the capabilities of our HECM Calculator, Pricing Platform, and HMBS Valuation Platform with Pool Pricer. The application provides helpful industry definitions and loan specific details. You can use the information for your own loan decisions or easily share opportunities with others on your origination team.

Add Your Heading Text Here

Whether your origination team is more experienced in the forward or reverse mortgage market, now anyone can instantly know the answer to the most important questions:

- Does the prospect qualify?

With very little information you know right away - How would the borrower benefit?

Simple interface lets you clearly show the value of a reverse mortgage to your borrower - What will you earn?

Clearly see how much a loan is worth whether you’re an HMBS issuer, Closed Loan Seller or an Originator selling to a rate sheet.

The HECM Neighborhood Widget

Place our interactive, engaging widget on your website to show visitors just how popular reverse mortgages are where they live.

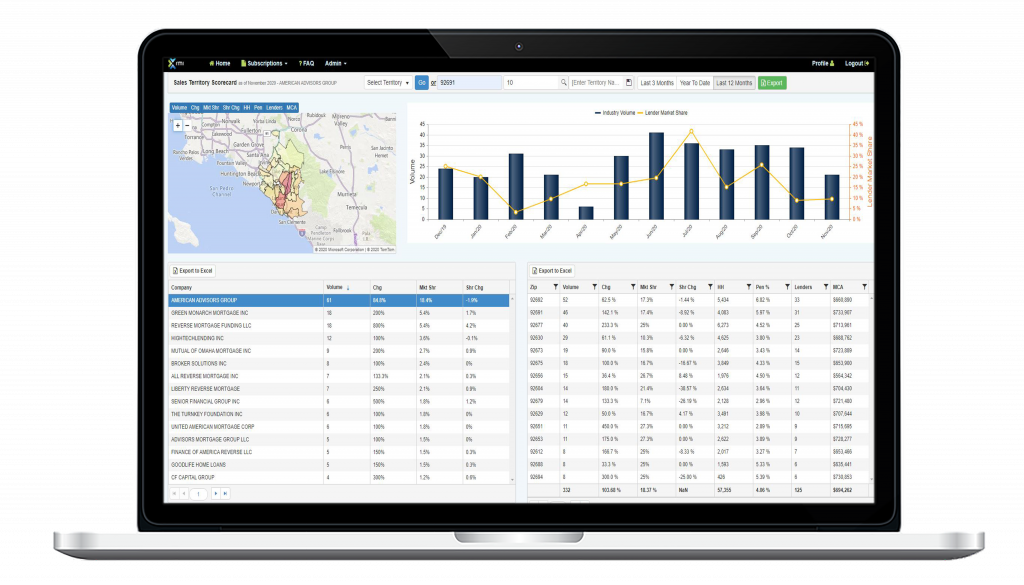

The Retail Dashboard

Know exactly where to focus.