Find Reverse Borrowers

Maximize Efficiency and Be First to Seize Loan Opportunities

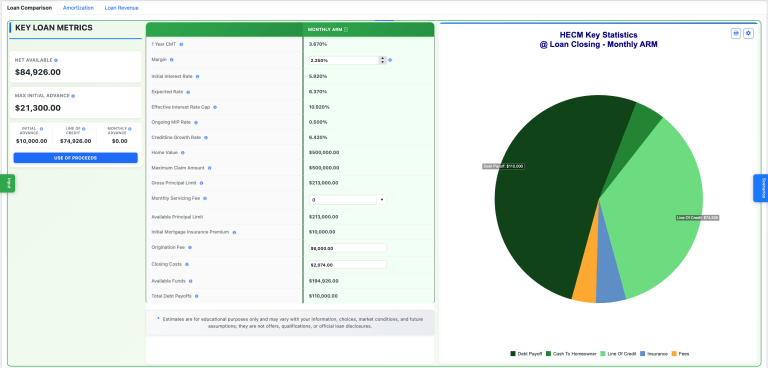

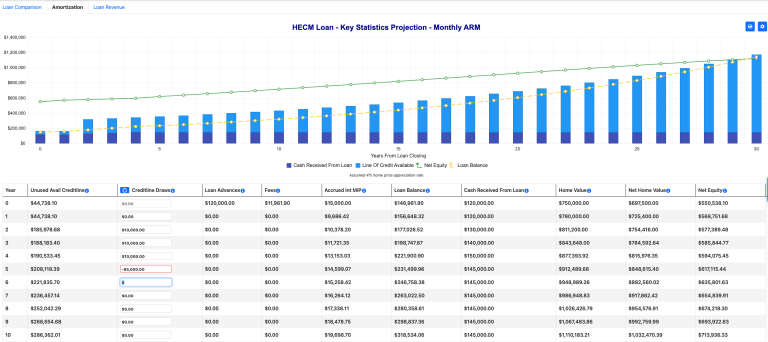

Reverse Qualifier

Make Confident Origination Decisions Using Clear and Current Market Data

Reverse Qualifier leverages our unmatched industry data analytics and integrates the capabilities of our HECM Calculator, Pricing Platform, and HMBS Valuation Platform with Pool Pricer. The application provides helpful industry definitions and loan specific details. You can use the information for your own loan decisions or easily share opportunities with others on your origination team.

Whether your origination team is more experienced in the forward or reverse mortgage market, now anyone can instantly know the answer to the most important questions:

- Does the prospect qualify?

With very little information you know right away - How would the borrower benefit?

Simple interface lets you clearly show the value of a reverse mortgage to your borrower - What will you earn?

Clearly see how much a loan is worth whether you’re an HMBS issuer, Closed Loan Seller or an Originator selling to a rate sheet.

The HECM Neighborhood Widget

Put local reverse mortgage data from our Scorecard tool right on your website

Increase engagement on your site with an interactive tool to:

- Show visitors how their neighbors are using reverse mortgages – based on local data

- Keep them on your site long enough to learn what you’re currently offering

- Help them easily request more information

Turn engagement into leads by:

- Branding the widget with your colors, language, photograph, and contact info

- Linking directly to your sales team

Retail Dashboard

Core Tools

Snapshot

Provides a high-level overview of production and competitive trends in multiple markets across the country at the state or county level, using HECM endorsement analytics, so lenders can:

- Improve marketing and sales efficiency nationwide

- Coordinate complex territory assignments

- Target recruiting efforts to maximize coverage

Scorecard

Lets originators see exactly where loans are being made. Wherever you have an office, or even an individual loan officer, you can zoom into production data at the zip code level. The Scorecard Tool lets you draw a radius around that physical presence and reveal the best places to invest your marketing and sales resources:

- See exactly where your competitors – including those you currently beat – are opening offices

- Know where the most loans are being originated

- Originate more loans in every top HECM county, HECM city and HECM zip code near you

Market Opportunity

Shows reverse mortgage data for an entire state down to the local level. You can easily see HECM endorsement reports by individual market, reporting with HECM statistics including volume, market share, average Maximum Claim Amount and total market size for every state in which you operate so you can:

- Target more borrowers

- Maximize the return on every marketing dollar spent

- Get a more meaningful message in front of the right audience the first time

- Recruit top talent

Optional Tool

Origination Summary

An immediate overview of any company in the mortgage industry

- See the business they’re doing by geography, volume, channel, product type.

- Know if they are originating their own loans and who they are selling to

- Search Google, Facebook and LinkedIn at once to display trade names, contact information, websites and social media accounts.

Learn How to Supercharge your Reverse Mortgage Marketing

RMI’s latest ebook gives you step-by-step instructions for localizing your marketing efforts using our timely and accurate market data.

"*" indicates required fields

API Integration

Layer RMI Capabilities Upon Your Current Business Processes

Enhance the capabilities of your current systems with RMI’s expert services, tools, and powerful APIs that connect you to the most accurate and comprehensive database in the industry

- Product Qualification API surfaces ideal reverse mortgage prospects in your forward servicing book and CRM to expand your business:

- Generate additional revenue from prequalified prospects

- Show people who already have a trusted relationship with you how they can generate additional cash flow in retirement without selling their home or sacrificing their investments

- Preserve your portfolio by providing the most value to current borrowers

- Show customers how HECM for Purchase can unlock their dream move

- Wholesale API puts state-of-the-art analysis and reporting within your internal applications. Wholesale lenders use the API to integrate RMI’s wholesale volume data directly into their CRM tools to give AE’s fast and easy access to volume trends and customer capture rates.

- Retail Dashboard API puts the conversion lifting power of social proof inside your sales funnel and other customer-facing forms. Originators use the API to integrate RMI’s reverse mortgage household and volume data into sales and marketing tools.

- HECM Neighborhood API puts our market data and analytics anywhere you need it on your web site to better engage prospects with timely, convincing social proof of HECM popularity. Add convincing data to your lead funnel and build compelling, custom landing pages to track prospects from the very beginning of your sales process and keep them engaged to the end.

Choose How Deep To Dive Info Comprehensive Reverse Market Data

| Generating Leads (Widget Only) |

Most Popular (Snapshot, Market Opportunity, Scorecard which includes Widget) |

Looking to Grow (Add Origination Summary) |

|

|---|---|---|---|

| Engage potential customers on your website | |||

| Convert website visitors into your lead funnel | |||

| Know where reverse loans are most popular | |||

| See exactly where your competition is strongest and weakest | |||

| Get more meaningful messages in front of the right audiences the first time | |||

| Target more borrowers | |||

| Recruit top talent | |||

| Search Google, Facebook, and LinkedIn with one click API integrations to find contact information, websites, and social media accounts | |||

| See the business a company is doing by geography, volume, channel, product type | |||

| Create internal rate sheets for loan officers or net branches | |||

| Upload investor rate sheets and set custom profit margins |

Technical Service and Pricing

Monthly subscriptions and feature selections can be customized to your team’s specific needs.