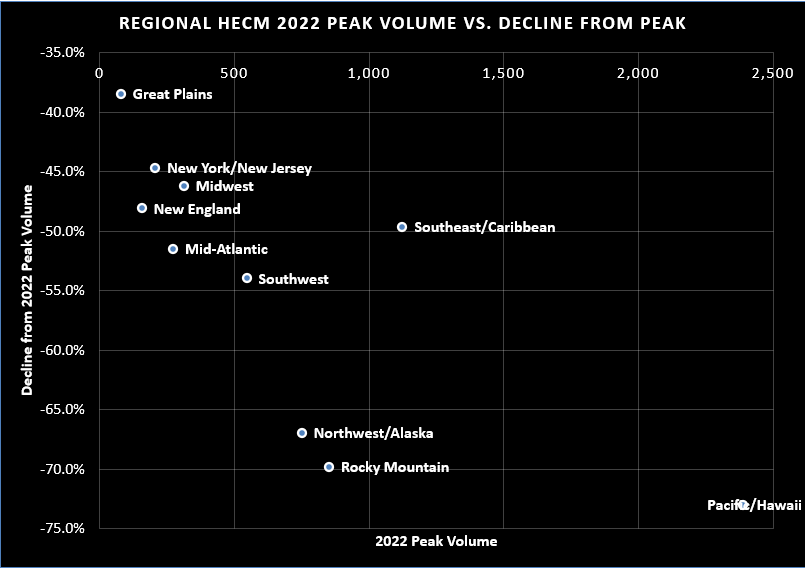

January HECM endorsements dropped a further -10.7% to 2,489 loans. Rather than beat a dead horse, a picture felt more appropriate here:

It’s clear that the regions with the highest volume peak in 2022 were also generally the ones to decline the most. That’s the epitome of what we continue to see as the first real refi bust for the reverse mortgage industry (immediately after the biggest refi boom for the same).

Just 2 of the 10 regions managed a gain month over month:

- Midwest inched up 2.4% to 168 loans

- New York/New Jersey bounced back 23.9% to 114 loans

Four of the top ten lenders gained ground:

- Hightech rebounded sharply, up 189.55 to 55 loans

- FAR gained 54.2% to 182 loans

- Fairway rose 30% to 234 loans, its highest since August

- Cherry Creek was up 4.9% to 64 loans

Click the image below for the full report.