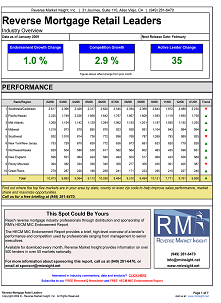

After a big improvement last month, HECM endorsements declined slightly in April to finish at 5,770 loans, down -1.2% from March. That figure was still good enough for 2nd highest in the past 12 months, behind only last month.

Regional volumes were mostly down, with 6 of the 10 regions declining.

- The top 2 regions, Southeast/Caribbean and Pacific/Hawaii both increased, each turning in their highest performance of the past 12 months.

- Rocky Mountain and New England also increased, with the former also setting a 12 month high and the latter just missing.

- Midwest declined the most, dropping -17.1% from March. Don’t let that fool you though, this region is up the most year to date at 20.9%.

Among lenders, there continues to be a shakeup as Metlife and FNB Layton are slowly working their way out of the top 10.

- Liberty retains its number one title for the trailing 12 months but Security One is close behind and took the top spot for April’s single month volume

- One Reverse continues its steady ascent up the charts with its first month above 500 loans endorsed

- As Metlife and FNB Layton drop off, it looks as though Sun West, Maverick and Associated Mortgage Bankers are in a three way race to jump into the top 10.

HECM Originators and HECM Trends are expected back shortly, hopefully this month. Cross your fingers that doesn’t fall to the sequestration ax!

Please click the image below for the full report.