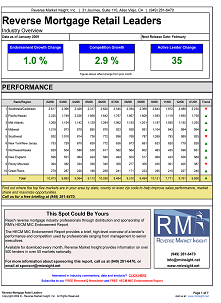

HECM endorsements were down 7.2% in May to 5,352 loans and continuing a modest trend of weakness since the recent peak in March. Year to date volume is up 12.4%, while competition as measured by active lenders is up 3.0%

With the 4/1 moratorium on new applications for HECM standard fixed rate products, one of the popular topics of conversation in the industry was what the product mix would look like after the change. With two months of applications under our belts it appears that the immediate shift to ~95% ARMs from 70-75% fixed rates previously has held firm and will be with us for the foreseeable future.

Relative to fixed rate products, the lower initial balance applied in many cases to a lower sales premium on ARM loans is already and will continue to create a reduction in average revenue per loan. Whether that leads to origination and servicing fees returning to our industry is yet to be determined, but clearly something has to give.

If you’re looking for ways to sharpen your lead generation and sales conversion focus, give us a call. Worst case is we spend 15 minutes sharing some ideas with you, but best case is we arm you with the information to thrive in a challenging period for your company.

Please click the image below for lender rankings and more in the full report.